Does Your Law Firm Have a Compliance Program – and How Ethics Rules Discourage Them

Although many law firms advise corporate clients on compliance, few firms have compliance programs in place observe Compliance strategists Donna Boehme and Joseph Murphy in this terrific piece, Inconvenient Truths About Law Firm Compliance. That law firms are subject to ethics rules is no excuse, contend Boehme and Murphy. Legal ethics rules didn’t deter the well-publicized DLAPiper billing debacle, nor do they address risks common to most corporate enterprises such as discrimination, social media issues, privacy and cyber-security. Boehme and Murphy go on to list the reasons that law firms should consider developing a compliance program — including its potential to serve as a selling point for corporate clients.

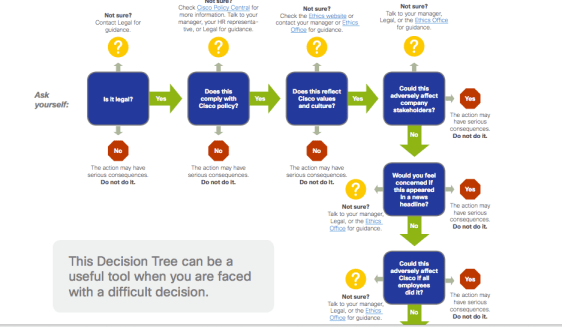

For solos and smalls, a compliance program seems like over-kill. But it does offer valuable benefits. Foremost, because a compliance program codifies a firm’s best practices and ethical and legal obligations and implements systems for compliance, a solo doesn’t have to explain the same procedures over and over again when he or she adds staff or outsources projects. Second, compliance programs and codes of conducts can empower employees by providing them tools to make decisions. In particular, ethics compliance decision trees can help new associates recognize, identify and learn to deal with ethics issues. Cisco designed a cool decision tree for its employees, and the same design could be replicated for a small firm.

While compliance programs have benefits, that’s often not enough to convince busy solos to devote scarce resources to creating one. And while bar associations could and should develop tools – like this stylish Cisco flowchart – for their members to “plug and play,” truth is, it doesn’t make sense for them to spend resources on them when the presence of a compliance program won’t necessarily serve as a mitigating factor in an ethics case. Of course, sometimes, a system – like instructions to an administrator about the importance of returning phone calls to the disciplinary committee can help avoid ethics problems like this one.

But a compliance program won’t help after the fact — so even if a firm does have procedures in place for making trust account deposits or researching and documenting ethics rules before engaging in a marketing campaign, these don’t count as mitigating factors in determining discipline. See, e.g., Standard 9, ABA Ethics Code (listing mitigating disciplinary factors including absence of motive, cooperation with tribunal, good faith effort to rectify consequences, etc…) By contrast, most compliance programs (such as the one I’m most familiar with) credit companies for effective preventive measures to ensure compliance.

Does your firm have a compliance program or systems in place? Let me know if you’d like to share.

Photo from the Cisco Code of Conduct E-book